In my initial post, we establish the expected salary ranges for various skill sets and expertise and in the last post, I discuss the sponsor’s share. Now, the last remaining piece is the Income Tax Deduction. I will discuss this in detail in this post.

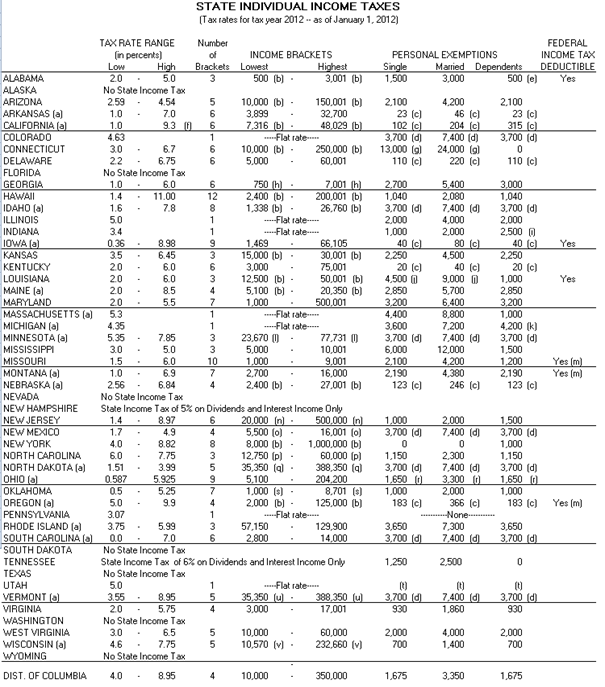

Taxes based on income are imposed at the federal, most state, and some local levels within the United States. The Taxable income is gross income less exemptions and deductions; where Gross income includes "all income from whatever source".

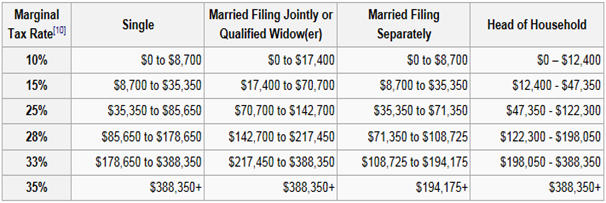

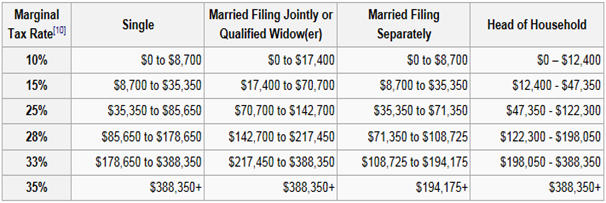

2012 Federal Income Tax Rates:

You can notice from the chart above, that a “single” resource will be taxed higher than the married one. On the same principle, if you have children or dependents (like parents, etc.), for each dependent you will be tax-exempted by a certain percentage/amount. The more the number of children or dependents, the higher tax-exemptions and hence lower income tax deductions.

So, if we continue our example of a Java Developer resource from our last post. The net annual salary for that resource will be:

On Employment Contract – US$ 3,500 per month x 12 = US$ 42,000 per year

On Consultant Contract – US$ 4,928 per month x 12 = US$ 59,136 per year

Federal Income Tax on Employment Contract:

25% of US$ 3,500 per month = US$ 875 per month

Federal Tax on Consultant Contract:

25% of US$ 4,928 per month = US$ 1,232 per month

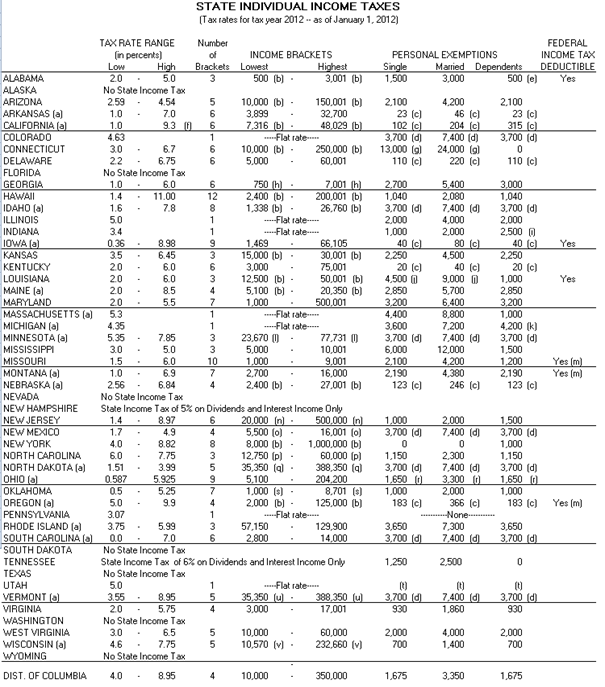

State Income Taxes

43 states and many localities in the United States impose an income tax on individuals. Tax rates vary by state and locality, and may be fixed or graduated.

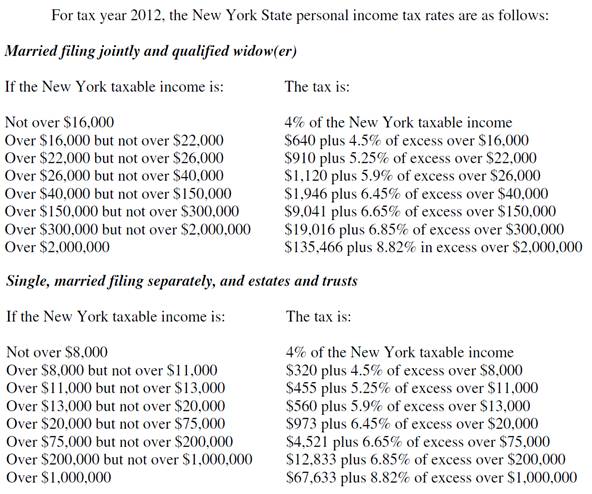

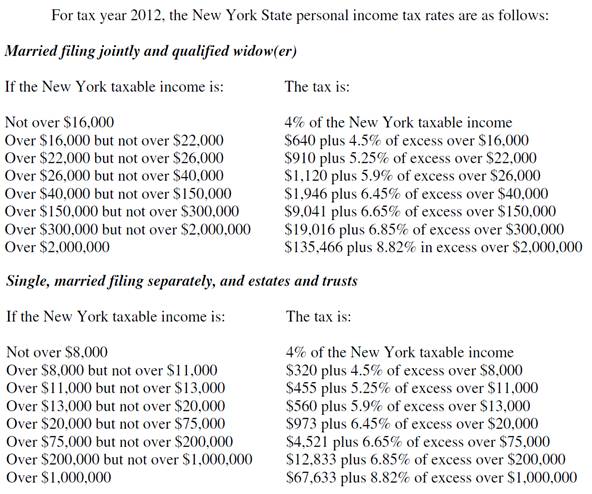

For our example, we assume that the resource is working in New York State.

The annual salary for the resource is:

On Employment Contract – US$ 3,500 per month x 12 = US$ 42,000 per year

On Consultant Contract – US$ 4,928 per month x 12 = US$ 59,136 per year

Hence,

New York State Income Tax on Employment Contract:

US$ 973 + 6.45% of [ US$ 42,000 per year – US$ 20,000 ] = US$ 2,392 per year or US$ 199.34 per month

New York State Income Tax on Consultant Contract:

US$ 973 + 6.45% of [ US$ 59,136 per year – US$ 20,000 ] = US$ 3,497.27 per year or US$ 291.44 per month

So, the net take home salary will be:

On Employment Contract:

US$ 3,500 per month - US$ 875 per month (Fed. Tax) - US$ 199.34 per month (NYS Tax)

= US$ 2,425.66 per month

On Consultant Contract:

US$ 4,928 per month – US$ 1,232 per month (Fed. Tax) – US$ 291.44 per month (NYS Tax)

= US$ 3,404.56 per month

City/Area/Locality Income Taxes

14 states and the District of Columbia allow cities, counties, and municipalities to levy their own separate individual income taxes in addition to state income taxes. These include:

- Alabama: Birmingham levies an income tax of 1%

- Arkansas: Seven Arkansas school districts assess an income tax surcharge equal to 10% of state income tax before tax credits. They are: Berryville, Green Forest, Westside, Hope, Huntsville, Waldron, and Marshall.

- Colorado: Three cities impose flat taxes on compensation. Aurora charges $2 per month on compensation over $250, Denver charges $5.75 per month on compensation over $500, and Greenwood Village charges $4 per month on compensation over $250.

- District of Columbia: D.C. has a bracketed income tax system. The rates are 4% for the first $10,000 of income, 6% for $10,000 to $40,000 of income, and 8.5% for income over $40,000.

- Delaware: Wilmington has a flat 1.25% tax on income.

- Iowa: 666 school districts impose an income tax surcharge ranging from 1% to 20% of state income tax owed.

- Indiana: All 92 counties in Indiana have an individual income tax. Tax rates are in the process of being changed, and will be announced on the Indiana Department of Revenue’s website once they are finalized.

- Kentucky: Eight cities in kentucky levy income taxes on residents and non-residents. They are: Bowling Green (1.85%), Covington (2.5%), Florence (2%), Lexington-Fayette (2.25%), Louisville (2.20% for residents and 1.45% for non-residents), Owensboro (1.33%), Paducah (2%), and Richmond (2%). Lexington-Fayette Urban County Government and Louisville - Jefferson County also impose taxes on businesses.

- Maryland: All 24 Maryland counties levy income taxes on residents and non-residents. Tax rates range from 1.25% to 3.20%. Baltimore also has an income tax of 3.05%.

- Michigan: Several Michigan cities impose income taxes with rates ranging from 0.50% to 2.50%. Detroit’s income tax rate is 2.50% for residents and 1.25% for non-residents.

- Missouri: Both Kansas City and St. Louis have an income tax of 1%.

- New York: Yonkers and New York City both have individual income taxes. New York City's income tax rates range from 2.907% to 3.648%. Yonker's income tax rate is equal to 10% of your net (after credits) state income tax.

- Ohio: 235 cities and 331 villages in Ohio have an income tax, including Columbus, Toledo, Cincinnati, and Cleveland. Ohio law requires a flat rate that cannot exceed 1%, unless it is approved by the voters. Ohio local income tax rates range from 0.40% in Indian Hill to 3% in Parma Heights.

- Oregon: The Tri-Met Transit District (includes Portland) assesses an income tax of 0.6318% and the Lane County Transit District (includes Eugene) assesses an income tax of 0.60%. Multnomah County (Portland) also assesses a 1.45% business income tax.

- Pennsylvania: Most municipalities in Pennsylvania assess a tax on wages, known as the Earned Income Tax. This tax is usually split between the municipality and the local school district. The local Earned Income Tax is only assessed on earned income, like wages. Unearned income like interest and dividends are not taxed. Pennsylvania state law limits the Earned Income Tax to a maximum flat rate of 2%, but Home Rule cities like Philadelphia and Scranton are not subject to this maximum. Cities with tax rates above 2% include: Philadelphia (3.98%), Pittsburgh (3%), Reading (2.70%), Scranton (3.40%), and Wilkes-Barre (2.85%). Non-residents have to pay the Earned Income Tax as well, but are usually taxed at a lower rate. You can look up local tax rates on Pennsylvania state's website. Local income taxes are also assessed on the net profits of businesses.